The Credit Counselling and Debt Management Agency (AKPK – Agensi Kaunseling dan Pengurusan Kredit) serves as the one-stop platform for both individuals and SMEs seeking debt restructuring services, as well as financial education and advisory services. AKPK offers specialised solutions to help small and medium enterprises (SMEs) manage their debt and promote sound financial management practices via the following:

- AKPK Debt Management Programme for sole proprietors

- Small Debt Resolution Scheme (SDRS) for SMEs which are non-sole proprietors

Effective 1 September 2020, the SDRS function for SMEs was transferred from Bank Negara Malaysia (BNM) to AKPK.

AKPK can now provide more efficient and holistic debt restructuring and advisory services for SMEs that have loans/ financing with SDRS’s participating banks. SMEs can approach AKPK to seek debt repayment assistance under the SDRS when:

- their application for repayment assistance with their bank is rejected: or

- their application is approved but the repayment terms offered are not agreeable to the SMEs.

- For SMEs that have loans/financing with multiple banks, they can approach AKPK directly where AKPK will facilitate their debt restructuring request and arrange for lenders to meet with the banks involved.

What is SDRS?

SDRS provides assistance to SMEs facing difficulties in repaying their business financing obligations with the banks. This is done through the facilitation of debt repayment arrangement for the SMEs with the bank(s) in an amicable and collective manner, without resorting to legal recourse.

The SDRS under AKPK is an additional avenue for SMEs to obtain help and advice on debt restructuring and rescheduling, complementing the efforts of the banking industry to provide relief to distressed SMEs.

Who can apply for the SDRS?

- SMEs that have business financing from participating banks of SDRS (no minimum or maximum financing amount)

- SMEs that are not wound up nor in receivership or under judicial management

- Owner(s)/shareholder(s) of the SMEs is not a bankrupt

- SMEs that have ceased operations but with identified income/sources of funds to meet the loan financing repayment obligations

Who are the participating banks?

All Commercial Banks

All Islamic Banks

6 Development Financial Institutions (DFIs) regulated by BNM:

- Bank Pertanian Malaysia Berhad (Agrobank)

- Bank Kerjasama Rakyat Malaysia Berhad (Bank Rakyat)

- Small Medium Enterprise Development Bank Malaysia Berhad (SME Bank)

- Export-Import Bank of Malaysia Berhad (EXIM Bank)

- Bank Simpanan Nasional (BSN)

- Bank Pembangunan Malaysia Berhad (BPMB)

How can SMEs approach AKPK?

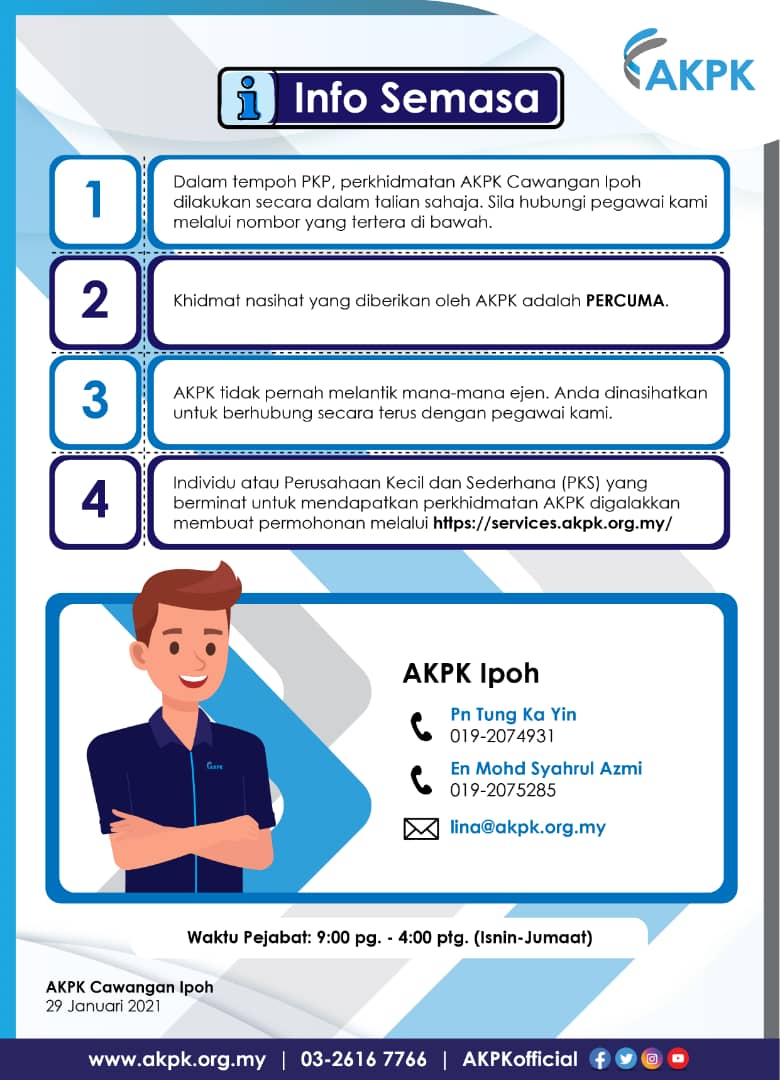

AKPK’s services can be accessed via the online channel at https://services.akpk.org.my . During the CMCO in Sarawak, customers are advised to utilise AKPK’s online services as part of the physical distancing measures to ensure effective containment of the COVID-19 pandemic.

Services under SDRS are offered FREE OF CHARGE. AKPK does not appoint third party agents to act on its behalf.

=============================

Get your local news fast. Download the Ipoh Echo App on your mobile. Available on both Google Playstore and Apple Appstore.